Things are getting complicated for the Walt Disney Company.

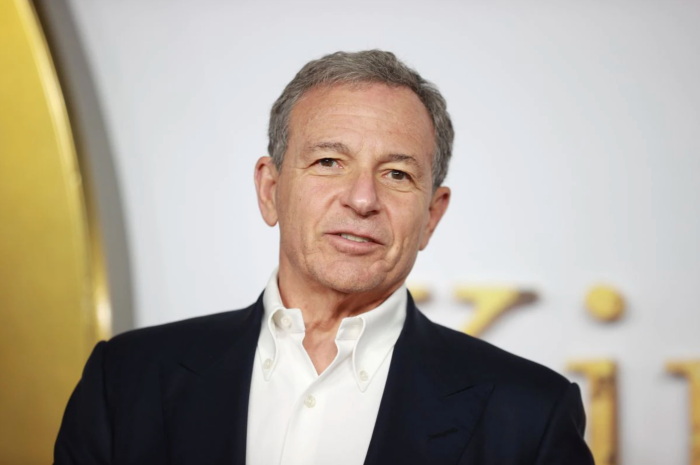

Former CEO Bob Chapek left not long ago and Bob Iger suddenly returned to his CEO role. Since that time, we’ve seen slight increases in stock values, drops in stock value, and an activist’s attempt to bid for a seat on the Board of Directors of the Walt Disney Company. Now, we’ve got an update on what’s going on.

What Disney Has Said

According to a recent SEC filing, Disney has indicated that their current Board of Directors is the “right board for shareholders.” This comes after an activist group suggested that Disney has “lost its way” and pushed for Nelson Peltz to be elected to be on Disney’s Board of Directors (more on that in a second).

In the filing from Disney, they note that the board is independent and “highly qualified” and that it has “provided strong oversight focused on delivering superior, sustained shareholder value.” Disney goes on to discuss just how involved the Board is in reviewing the strategic direction of the company, including with the launch of Disney+, their decisive actions to “address leadership challenge,” and their focus on succession planning.

They also went on to discuss the incoming Board Chairman — Mark Parker — and why Parker is an asset to the Board, and mentioned Carolyn Everson, who was added to the Board in 2022, and the skills she offers.

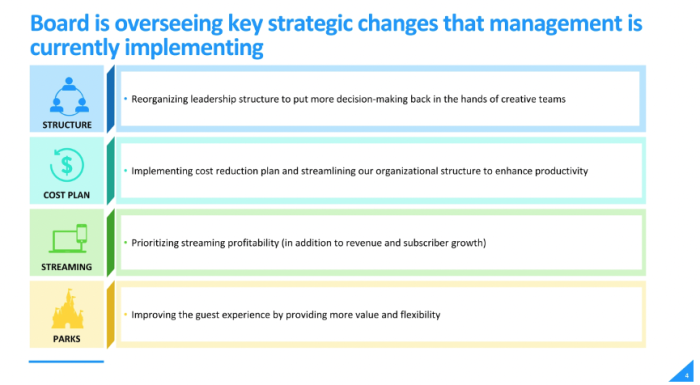

When it comes to key changes coming to Disney, the SEC filing notes that the Board is working on key strategic changes that are being implemented by management. Those changes include reorganizing some of the structure of the Company to give decision-making back to creative teams (something Iger indicated he would do when he returned as CEO), putting a “cost reduction plan” in place, “prioritizing streaming profitability,” and, at the Disney parks, improving the experience for guests by “providing more value and flexibility.”

We have seen some key things change in the parks lately, especially when it comes to the Disney Dining Promo Card deal and the return of free parking at the Disney World hotels.

Disney then makes it abundantly clear that they do NOT want Nelson Peltz to be on the Board by saying that Peltz “does not understand Disney’s business and lacks the skills and expertise to assist the Board in delivering shareholder value in a rapidly shifting media ecosystem.” Really, it couldn’t be any more clear.

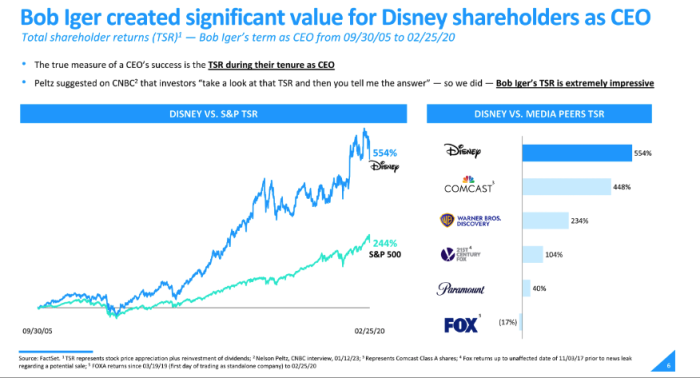

The filing then goes on to talk about how Iger created value for shareholders during his time as CEO, specifically in terms of total shareholder returns (which is defined as stock price appreciation plus reinvestment of dividends).

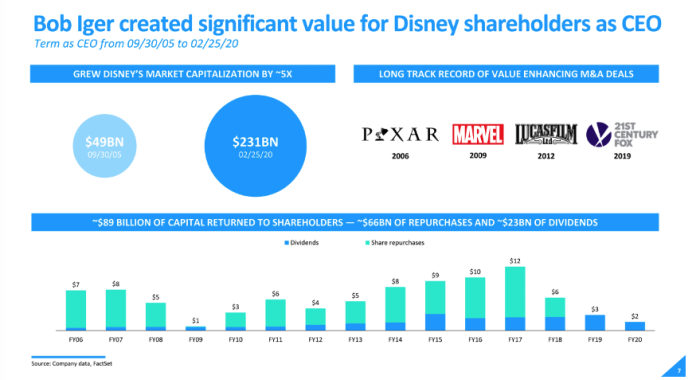

They also discuss how Iger added value by growing Disney’s market capitalization…

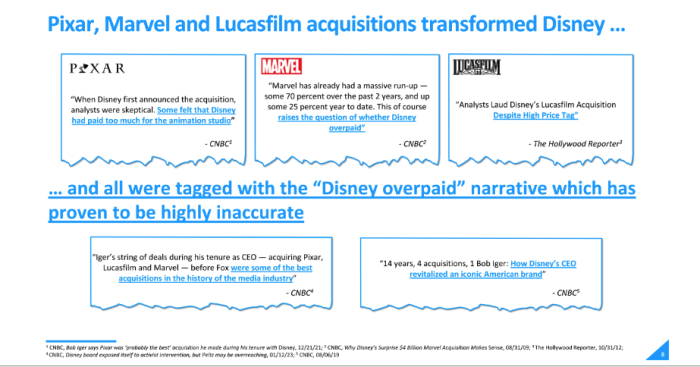

…and making key acquisitions (like of Pixar, Marvel, and Lucasfilm) that “transformed Disney.”

That includes the Fox acquisition. Disney specifically notes that by acquiring Fox, they “broadened [their] portfolio of world-class IP,” enabled their direct-to-consumer side to expand quickly, and enriched the Company with the knowledge and experience of members of the Fox team.

Disney then discusses the issues with some of Trian’s analysis. Trian Partners L.P. and Trian Partners Parallel Fund I, L.P. are the entities that have nominated Nelson Peltz to become a director on the Disney Board of Directors. CNBC calls the Trian Partners group an “activist firm.” They own about 9.4 million shares in the Disney Company.

Peltz was reportedly opposed to the return of Bob Iger as the company’s CEO. And Peltz has expressed his opinion on a number of other things, indicating that “Fox hurt this company” and “took the dividend away.” Peltz has also indicated that Disney should get out of streaming entirely or buy all of Hulu.

The Trian Group has weighed in on what it considers to be “poor corporate governance” at Disney, “over-the-top compensation practices,” and “failed succession planning.”

Peltz has indicated that he wants to work with Iger to ensure a smooth transition 2 years from now, get access to internal numbers to see what opportunities Disney is missing out on, and more.

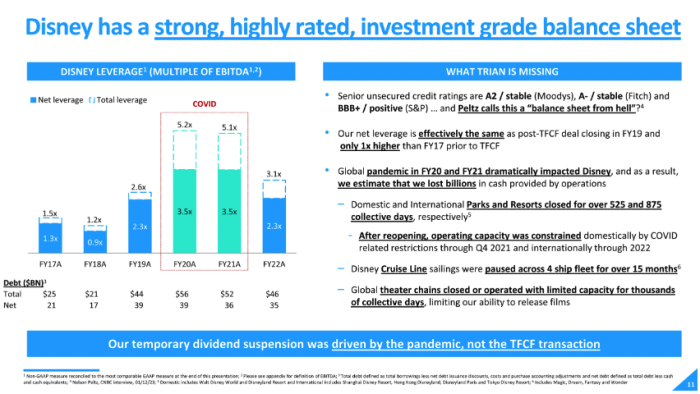

But, again, Disney has opposed Peltz’s proposal to get on the Board. Instead, they insist that Disney has a highly rated investment grade balance sheet, unlike what Peltz has called a “balance sheet from hell.” And they point out some things the Trian group is potentially not focusing on enough — like the impact of the global pandemic. Disney insists that the dividend suspension was due to the COVID-19 pandemic, and not the Fox transaction.

We reported back in May of 2020 when CFO Christine McCarthy said that Disney would be suspending its dividend payout. At that point, Disney indicated that they would revisit the dividend over the next 6 months once the Company had a better idea of the impact of the COVID-19 closures. Thus far, dividends have not been reinstated.

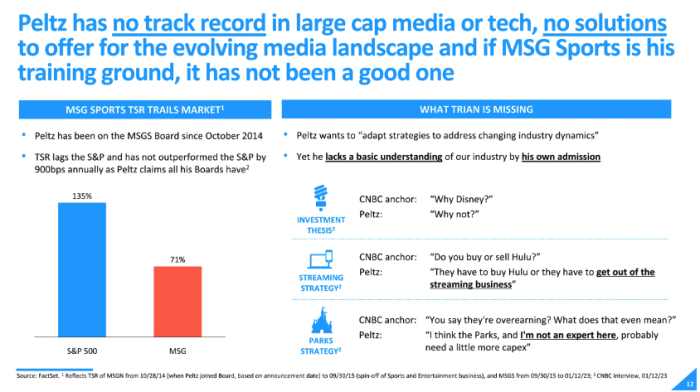

In the SEC filing, Disney goes on to note that Peltz has NO track record in large cap media or tech, and NO solutions that he could offer for the evolving media landscape. They also critique Peltz’s history with MSG sports and say that if that is his training ground, “it has not been a good one.”

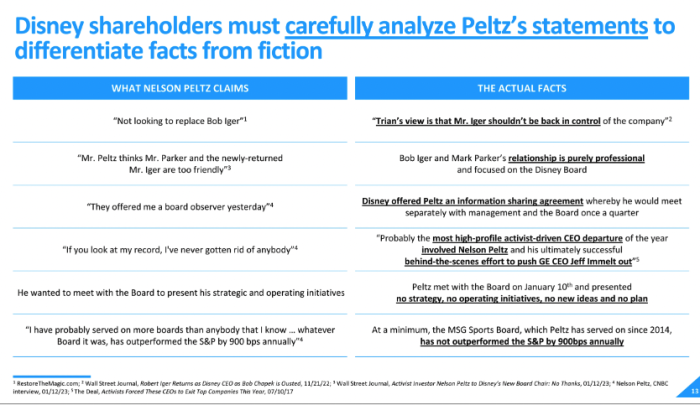

They also insist that shareholders “carefully analyze Peltz’s statements to differentiate facts from fiction.” That slide shows some of Peltz’s comments as opposed to what Disney terms “the actual facts.” They go through Peltz’s own reported intentions, his reported work in pushing GE CEO out of office, and more.

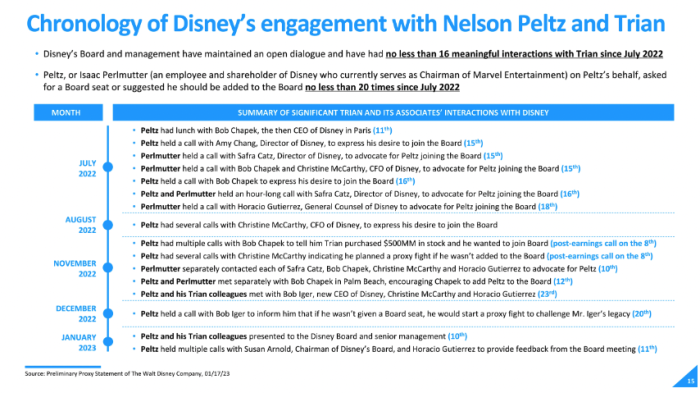

And finally, Disney ends with a chronology of Peltz’s interactions with Disney, dating back to the lunch he had with then-CEO Bob Chapek in July of 2022 in Paris. It goes through Peltz’s various calls with Disney officials and executives as he expressed his desire to join the board.

Things then turned a bit more complicated in November of 2022, when Peltz had calls with Christine McCarthy (Disney’s CFO) and indicated that he “planned a proxy fight if he wasn’t added to the Board.” This appears to have been reiterated in December 2022 when Peltz reportedly had a call with Iger and said that if he wasn’t given a seat on the Board he’d start a proxy fight to “challenge Mr. Iger’s legacy.”

(A proxy fight is defined by Cambridge Dictionary as a situation where a group of investors that wants to take control of a company tries to “persuade shareholders of that company to vote at shareholders’ meetings in a way that helps the investors achieve what they want.”)

All in all, the SEC filing appears to be a strong showing of Disney’s support for Iger and their opposition to Peltz’s proposals to get on the Board of Directors.

Disney followed this up with another SEC filing for shareholders. They note that shareholders’ votes are “especially important” at the annual meeting this year, especially as the Trian group seeks to get Peltz on the board. They then clearly note, again, that the current Board of Directors of Disney “does not endorse the Trian Group nominee or the Trian Group Proposal.”

According to Disney, “Your vote is extremely important no matter how many shares you own.”

They then go into more detail about why Disney does not recommend Peltz become a member of the Board, including: “despite months of engagement, Mr. Peltz had not, and the Trian Group representatives at the meeting had not, actually presented a single strategic idea for Disney, that their assessment of Disney seemed oblivious to the secular change that had been ongoing in the media industry, as well as the impact of the pandemic on each part of the Company’s business from production, to exhibition, to leisure travel.”

Again, it appears to be a critical showing of support for Iger and opposition to Peltz. The date for the 2023 shareholder meeting has not yet been shared, but in 2022 it took place on March 9th. We’ll be on the lookout for updates there.

In the meantime, Disney has announced that their Q1 Fiscal Year 2023 Earnings call will take place on February 8th, 2023, so we’ll learn more about the financial status of the Company then.

What do you think will happen with Peltz and the Board? Tell us in the comments. At this point, only time will tell what the future of the Company will be like. Much remains to be seen. Stay tuned for the latest Disney news.

Click here to learn about the succession planning taking place at Disney to find Iger’s eventual replacement

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

WE KNOW DISNEY.

YOU CAN, TOO.

Oh boy, planning a Disney trip can be quite the adventure, and we totally get it! But fear not, dear friends, we compiled EVERYTHING you need (and the things to avoid!) to plan the ULTIMATE Disney vacation.

Whether you're a rookie or a seasoned pro, our insider tips and tricks will have you exploring the parks like never before. So come along with us, and get planning your most magical vacation ever!

What do you think will happen with Peltz and the Board? Tell us in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

I have to wonder if all the board members go to Disney every year and if they have to go thru all the hoops they put in place just like all us normal people have to. I have a suggestion-get all the higher-ups to book a vacation for them and their families without the perks they are used to. I think Bob and his cronies would have a different view of the park passes and genie plus and everything else we have to pay for.