A lot of things have changed over the past year and even just within the past few weeks and months for the Walt Disney Company. We’ve been keeping track of how some of those changes have impacted Disney’s financial standing by listening to Disney’s shareholder meetings and earnings calls.

Today is a big day for investors, as Disney is holding its Quarterly Earnings Call, covering Disney’s third quarter financials for fiscal year 2021. Ahead of that call, Disney has released its Q3 financial report. Now, we’re breaking down everything you need to know about how the Disney Company is doing financially at the moment.

Overall

From an overall perspective, the third quarter for the 2021 has proven to be positive for the Disney Company. According to a quote from Bob Chapek, Disney’s Chief Executive Officer, included in the Q3 financial report, Disney “ended the third quarter in a strong position, and are pleased with the Company’s trajectory as we grow our businesses amidst the ongoing challenges of the pandemic.”

According to Chapek, Disney is continuing to “introduce exciting new experiences at our parks and resorts worldwide, along with new guest-centric services, and [their] direct-to-consumer business is performing very well, with a total of nearly 174 million subscriptions across Disney+, ESPN+ and Hulu at the end of the quarter, and a host of new content coming to the platforms.”

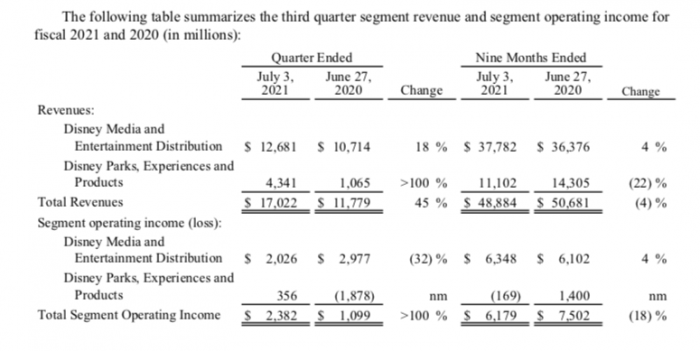

Here’s an overview of the third quarter results for the fiscal year 2021. Overall, revenues for the 3rd quarter for fiscal year 2021 were at around $17 billion. That’s a big jump compared to the same quarter last year where revenues were around $11 billion.

Overall, excluding certain items, the diluted earnings per share for this quarter increased to $0.80 compared to the $0.08 value it was at during the prior-year quarter.

Let’s break down some of the big items from the report.

Parks, Experiences and Products

When it comes to the theme parks, Disney’s third quarter report notes that since early 2020 and into 2021, COVID-19 and measures to prevent its spread have impacted the company’s segments in various ways. But, Disney notes that its theme parks and resorts resumed operations (generally at reduced capacity) between May 2020 and June 2021. Disney’s cruise ships have also returned to sailing.

According to Disney, they will continue to incur costs to address government regulations and implement safety measures. Disney’s report shares that they expect these costs to be approximately $1 billion for fiscal 2021.

Once again, Disney has noted that the most significant impact on its operating income has been at Parks, Experiences, and Products. According to Disney’s report, “segment operating income for Disney Parks, Experiences and Products segment in the current nine-month period declined $1.6 billion compared to the prior-year nine-month period due to COVID-19.”

But, when this last quarter is compared to the same quarter last year, things at parks, experiences, and products actually did better in fiscal year 2021. You can see that the revenue for parks, experiences, and products was $4.3 billion at the end of this quarter, compared to the about $1.1 billion from the prior-year quarter. Disney notes that “Segment operating results increased $2.2 billion to income of $356 million.” This is compared to a loss of about $1.87 billion during the same quarter last year.

In terms of how this breaks down further, there was about $2.6 million in revenue from the domestic section of parks & experiences, $526 million in revenue from the international parks, and about $1.1 billion in revenue from consumer products.

In terms of operating income, Disney made about $2 million in the domestic parks & experiences segment. This is a big change from the loss of nearly $1 billion in the same quarter during the previous year.

Disney also reported a loss of $210 million from international parks & experiences (again, less than the $438 million loss reported during the same quarter last year). In terms of consumer products, there was a total supplemental operating income of $564 million. This is up from the income reported during the same quarter last year ($144 million).

Overall, the total supplemental operating income for Parks, Experiences, and Products was at $356 million, again a big change from the over $1 billion loss reported during the same quarter in the prior year.

As CNBC notes, for the first time since the pandemic began, Disney’s theme parks division has actually returned to profitability.

In terms of just how different things were this quarter as compared to the same quarter last year, Disney noted that “Walt Disney World Resort and Shanghai Disney Resort were open for the entire quarter. In the prior-year quarter, Walt Disney World Resort was closed for the entire quarter and Shanghai Disney Resort was open for 48 days. Hong Kong Disneyland was open for 72 days in the current quarter and 10 days in the prior- year quarter. Disneyland Resort and Disneyland Paris were open for 65 days and 19 days respectively, during the current quarter, whereas these businesses were closed for all of the prior-year quarter.”

Media and Entertainment Distribution

Media and Entertainment Overall

In terms of Media and Entertainment Distribution, Disney notes that “COVID-19 had a negative impact at [their] Disney Media and Entertainment Distribution segment compared to the prior-year quarter and nine-month period as higher advertising revenue from the return of live sports programming was more than offset by higher sports programming costs.”

Here’s a look at some of the revenue and operating results for the Media and Entertainment Distribution segment. Overall, the revenues from linear networks, direct-to-consumer, content sales, licensing, and other sources in this section was $12.68 billion. During the same quarter of the prior year, the revenue was $10.7 billion.

In terms of operating income, the total for this quarter was $2.026 billion, while the income from the prior year’s quarter was $2.977 billion. Disney discusses the reason for some of this loss in terms of higher programming and production costs, and other matters.

Disney+ and Direct-To-Consumer

When it comes to Disney’s direct-to-consumer services, Disney notes that its revenues increased “57% to $4.3 billion and operating loss decreased from $0.6 billion to $0.3 billion.”

When it comes to Disney+ specifically, Disney noted that the “higher loss at Disney+ was due to higher programming and production, marketing and technology costs, partially offset by an increase in subscription revenue and Premier Access revenue for Cruella in the current quarter.”

Here’s a look at the current number of Disney+, ESPN+, and Hulu subscribers. As of the latest report, Disney+ has a total of 116 million subscribers.

According to CNBC, this is actually higher than what some analysts expected Disney to report.

As you’ll note above though, the average monthly revenue per paid subscriber for Disney+ decreased to$4.16 this quarter (it was $4.62 for the quarter that ended on June 27th, 2020). Disney noted that this decrease was “due to a higher mix of Disney+ Hotstar subscribers in the current quarter compared to the prior-year quarter.”

Click here to see more about the current number of Disney+ subscribers.

We’ll continue to share more updates about information released in the earnings call so stay tuned for more news.

Click here to learn more about last quarter’s results!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Are you planning to visit Disney’s theme parks soon? Let us know in the comments.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Our handy (and portable!) ebook guides make sure you get the best deals and can plan a vacation of a lifetime.

Maybe now they can bring back all the employees that are still furloughed and out of work. Especially all the parking lot tram operators.

Well, if you stop and think about it…Disney has cut SO many things and they increased prices, many to ridiculous levels…they should be turning a profit….